Unknown Facts About Eb5 Investment Immigration

Unknown Facts About Eb5 Investment Immigration

Blog Article

Fascination About Eb5 Investment Immigration

Table of ContentsThe Eb5 Investment Immigration DiariesAbout Eb5 Investment ImmigrationWhat Does Eb5 Investment Immigration Mean?Our Eb5 Investment Immigration PDFsTop Guidelines Of Eb5 Investment Immigration

Contiguity is developed if census tracts share borders. To the extent feasible, the consolidated census systems for TEAs must be within one city area without any greater than 20 demographics systems in a TEA. The mixed demographics systems must be an uniform form and the address must be centrally situated.For even more information regarding the program visit the united state Citizenship and Migration Providers web site. Please allow 30 days to process your demand. We generally respond within 5-10 service days of receiving certification demands.

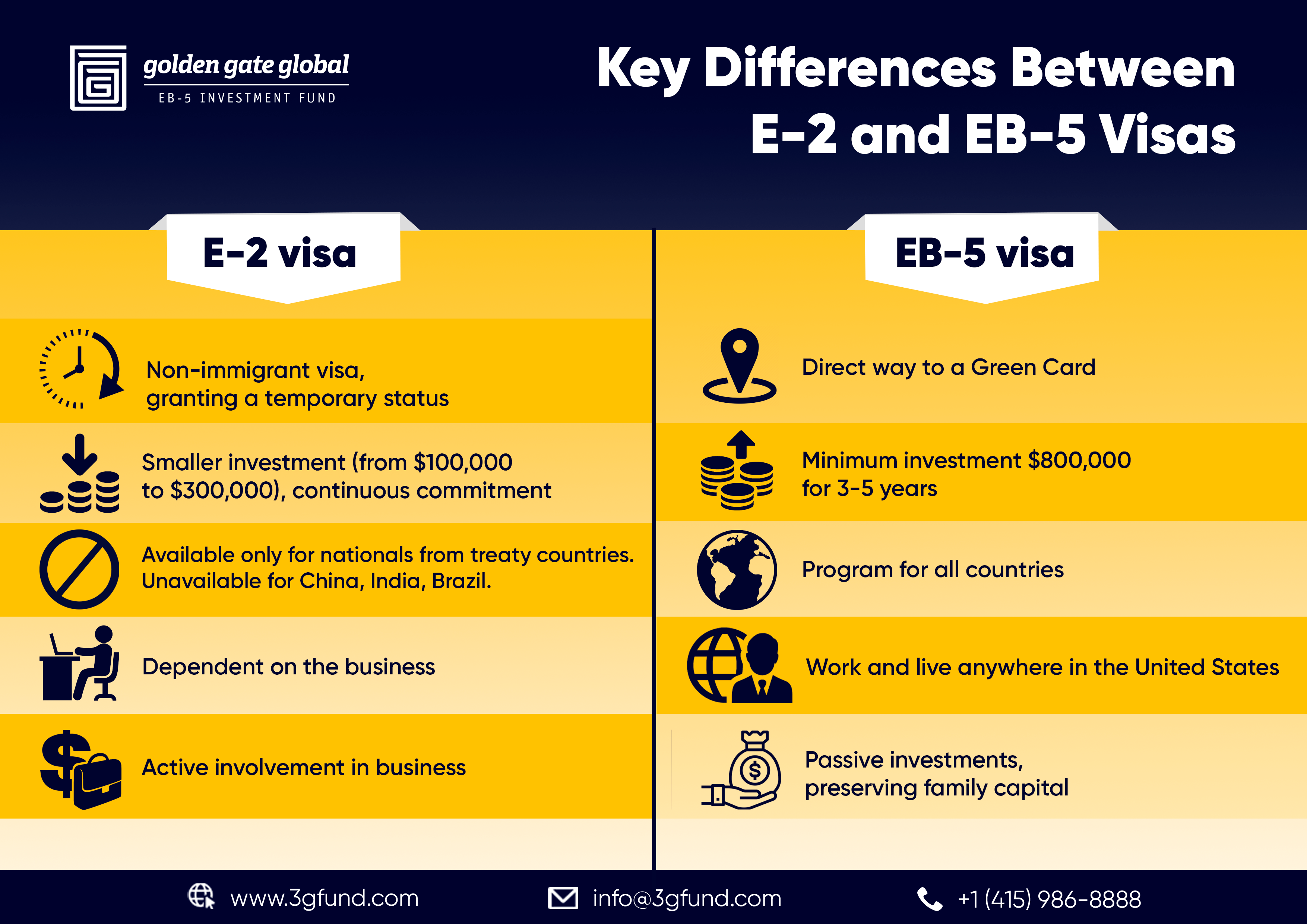

The U.S. federal government has taken steps aimed at increasing the degree of international financial investment for nearly a century. This program was expanded with the Immigration and Race Act (INA) of 1952, which produced the E-2 treaty financier class to further attract foreign investment.

workers within two years of the immigrant financier's admission to the USA (or in specific situations, within a reasonable time after the two-year duration). Furthermore, USCIS might attribute investors with preserving work in a struggling organization, which is specified as a business that has actually remained in existence for a minimum of two years and has actually endured a net loss during either the previous 12 months or 24 months before the concern date on the immigrant financier's preliminary application.

Fascination About Eb5 Investment Immigration

The program keeps rigorous funding demands, requiring candidates to show a minimum qualifying investment of $1 million, or $500,000 if bought "Targeted Work Areas" (TEA), that include particular marked high-unemployment or country areas. Most of the accepted regional facilities develop financial investment chances that are situated in TEAs, which certifies their foreign financiers for the lower investment threshold.

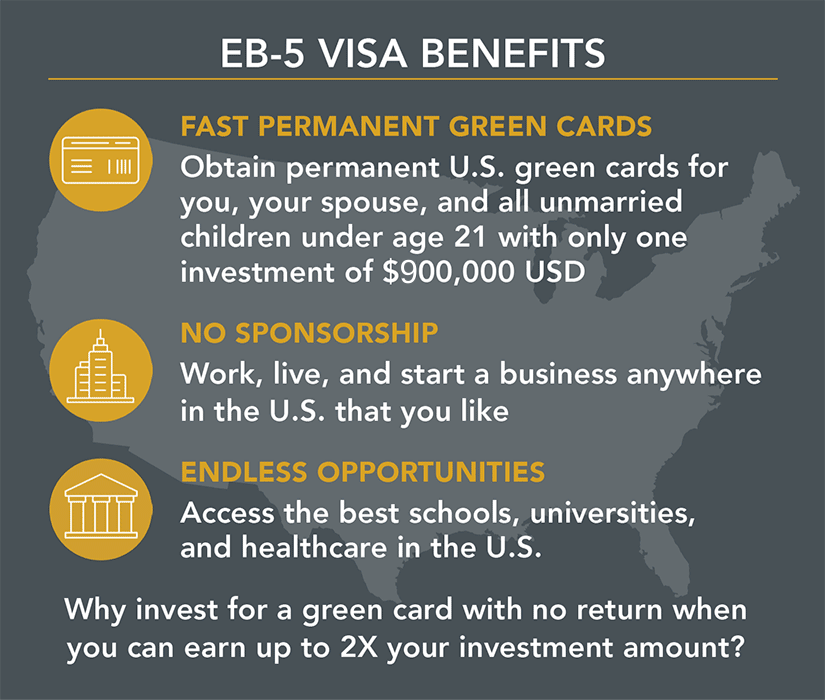

To receive an EB-5 visa, a financier should: Invest or remain in the process of investing at the very least $1.05 million in a new commercial business in the United States or Invest or remain in the procedure of investing a minimum of $800,000 in a Targeted Employment Area. EB5 Investment Immigration. (On March 15, 2022, these quantities enhanced; prior to that day, the U.S

Extra specifically, it's an area that's experiencing at the very least 150 percent of the nationwide average price of joblessness. There are some exceptions to the $1.05 million company investment. One method is by setting up the financial investment business in an economically tested area. You may contribute a minimal industrial financial investment of $800,000 in a country area with much less than 20,000 in populace.

Eb5 Investment Immigration Can Be Fun For Anyone

Regional Facility financial investments enable the factor to consider of home economic influence on the regional economic climate in the form of indirect employment. Affordable financial methodologies can be made use of to establish enough indirect employment to fulfill the work development need. Not all regional facilities are produced equal. Any kind of capitalist considering spending with a Regional Center have to be extremely mindful to consider the experience and success price of the company before investing.

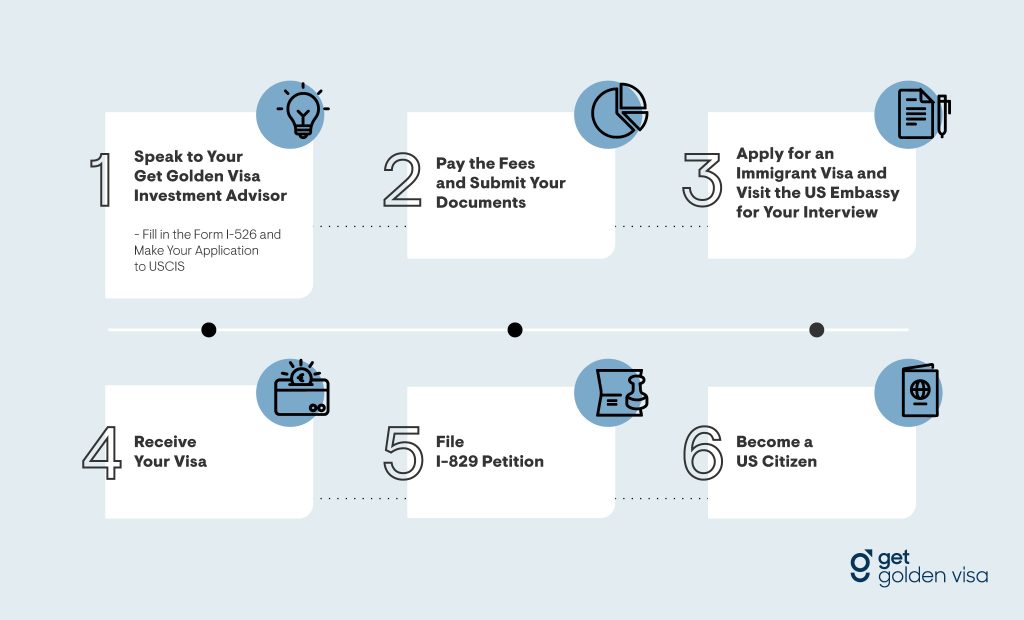

The financier initially requires to file an I-526 petition with U.S. Citizenship and Migration Provider (USCIS). This application should consist of evidence that the financial investment will certainly create permanent work for at the very least 10 U.S. people, long-term residents, or various other immigrants who are licensed to operate in the United States. After USCIS accepts the I-526 application, the capitalist may request a permit.

The Buzz on Eb5 Investment Immigration

If the capitalist is outside the United States, they will require to go via consular handling. Financier eco-friendly cards come with conditions attached.

Yes, in specific scenarios. The EB-5 Reform and Stability Act of 2022 (RIA) included area 203(b)( 5 )(M) to the INA. The new section normally permits good-faith capitalists to keep their eligibility after termination of their local facility or debarment of their NCE or JCE. After we alert investors of the discontinuation or debarment, they might retain qualification either by alerting us that they proceed to meet eligibility requirements notwithstanding the termination or debarment, or by amending their request to reveal that they meet the requirements under his explanation area 203(b)( 5 )(M)(ii) of the INA (which has various demands depending on whether the financier is seeking to retain qualification because their local center was ended or because their NCE or JCE was debarred).

In all instances, we try this website will make such decisions regular with USCIS plan regarding deference to prior resolutions to make sure consistent adjudication. After we end a regional facility's classification, we will certainly revoke any type of Type I-956F, Application for Authorization of an Investment in a Company, connected with the ended regional center if the Type I-956F was accepted as of the day on the regional center's discontinuation notification.

Some Of Eb5 Investment Immigration

Report this page